Understanding the Great Wealth Transfer: Why Families Need to be Prepared

Written by Robert T. Nickerson

The largest transfer of wealth between generations in history is happening right now, and many families are not ready for it. According to Michael Pelzar, head of investments at Bank of America Private Bank, this lack of preparation could lead to significant challenges down the road.

What Is the Great Wealth Transfer?

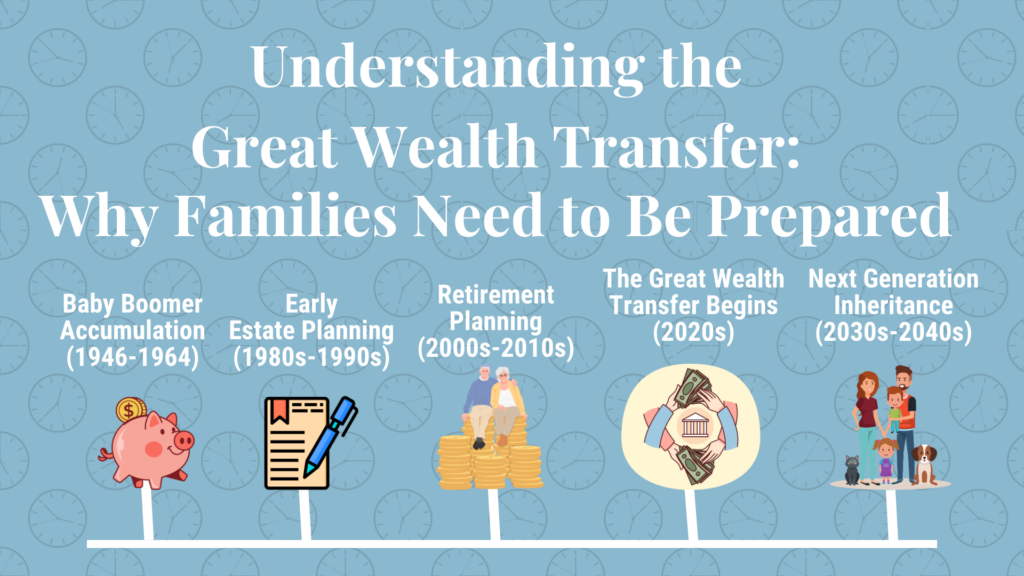

The “great wealth transfer” refers to the enormous amount of money that baby boomers—people born between 1946 and 1964—are expected to pass down to their children and grandchildren. Experts estimate that over $68 trillion will be transferred in the coming years. This isn’t just a concern for the ultra-wealthy; it affects all families who have assets they want to pass on to future generations.

Why Estate Planning Matters

Pelzar points out that nearly half of families, even those with significant wealth, do not have basic estate planning tools in place. These tools include a will, a power of attorney, and a healthcare proxy—documents that are essential for ensuring that your wishes are carried out and that your loved ones can inherit your assets smoothly.

Without these preparations, families may face complicated legal processes, disputes, and even financial losses when trying to transfer wealth from one generation to the next. Communication is often the key issue; when families don’t talk about their plans or fail to educate themselves about estate planning, problems are more likely to arise.

The Reasons Behind the Delay

Christina Lecholop, a certified financial planner at CAPTRUST, explains that many people put off estate planning because they feel overwhelmed by the complexity of the investment world, changes in retirement expectations, and the uncertain global environment. With so much information out there, it’s easy to feel paralyzed and not take any action.

However, Lecholop emphasizes that delaying these decisions can result in missed opportunities and make the process harder in the long run. The best time to start planning is now, no matter your financial situation.

Taking the First Step

Estate planning doesn’t have to be complicated. Lecholop suggests starting with a simple goal, like figuring out how to replace your income when you retire. From there, you can develop a plan that outlines how much you need to save, what kind of investment growth you need, and how long you need to save.

Once you have a basic plan, you can build on it as your financial situation evolves. The key is to invest with a clear purpose, choosing the right tools and understanding how they work for your specific needs.

Why It Matters for Your Family

Good estate planning isn’t just about protecting wealth; it’s about ensuring that your family is taken care of and avoiding unnecessary stress and conflict. As Pelzar says, no one wants to pass down problems to the next generation. With the right planning, communication, and education, you can help your family navigate the wealth transfer smoothly.

By taking these steps, you’re not only securing your family’s financial future but also setting an example for the next generation. Whether you’re dealing with modest savings or substantial assets, estate planning is a crucial part of preparing for the future.